Unless it’s a low-budget indie hit, most video game releases are backed by large-scale marketing campaigns aimed at building awareness. Among the usual promotional expenses, livestreaming influencers often play a key role, launching the game on release day to tap into the massive audiences on platforms like Twitch.

With that in mind, Streams Charts set out to measure just how much impact sponsored livestreams have on the overall viewership of newly released games. We analyzed Twitch data from the biggest game launches between January and May 2025, using a range of keywords to determine the proportion of total viewership that came from paid promotional streams. As it turns out, for some titles, including AAA releases, these streams delivered a very noticeable boost.

This analysis was conducted using tools available on Streams Charts. With an active PRO subscription, you’ll unlock a dedicated filter that lets you sort specifically for sponsored content. Add-on features also allow you to dive deeper and run advanced research, just like the one you're reading now.

To explore all available features and get access, visit our Pricing page.

The first five months of 2025 delivered a wave of exciting game releases, whether it was the surprise drop of The Elder Scrolls IV: Oblivion Remastered, the highly anticipated Monster Hunter: Wilds, or Schedule I, an indie phenomenon embraced by the gaming community. Unsurprisingly, the share of sponsored streams varied widely across these titles.

Our analysis showed that, on average, promotional streams accounted for 7% of total viewership across the top 50 new game releases from January to May. But the spread was anything but uniform. Donkey Kong Country Returns HD, a recent Nintendo Switch release, had virtually no promotional streams, with sponsored content making up less than 0.1% of its total watch time over the chosen period. In stark contrast, the co-op roguelike SWORN saw more than 28% of its watch time (measured from three days before launch through the first week post-release) driven by sponsored streams.

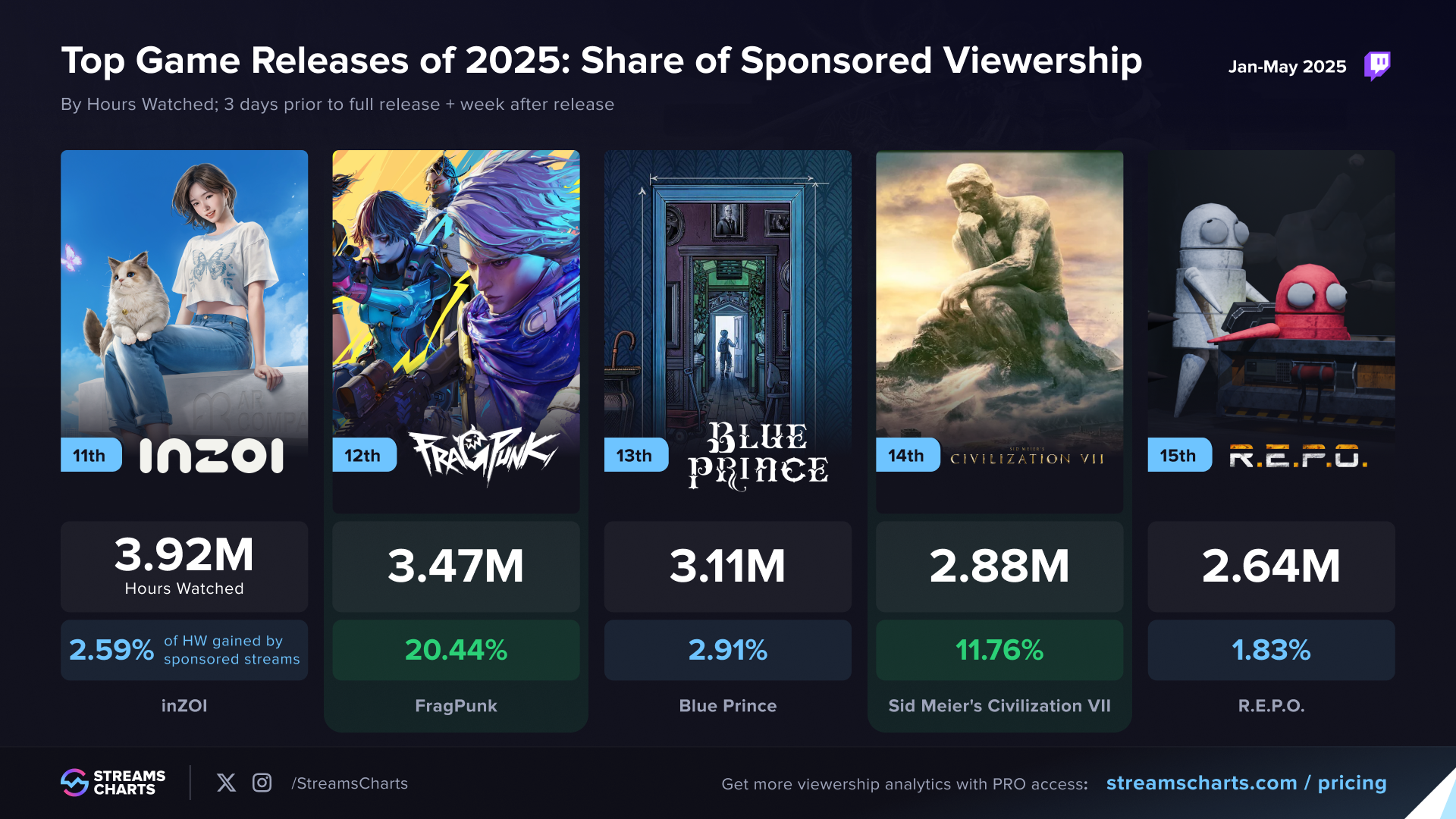

Narrowing the scope to the top 20 games, FragPunk, a first-person hero shooter, had the highest share of sponsored viewership, with promotional streams accounting for just over 20% of its total watch time.

But if we shift the focus from percentage share to total sponsored watch hours, the undisputed leader is Ubisoft’s Assassin’s Creed Shadows, which pulled in over two million Hours Watched (HW) from sponsored streams during the key launch window (three days before release through the following week). That’s 66% more than its closest competitor by this metric, Kingdom Come: Deliverance II.

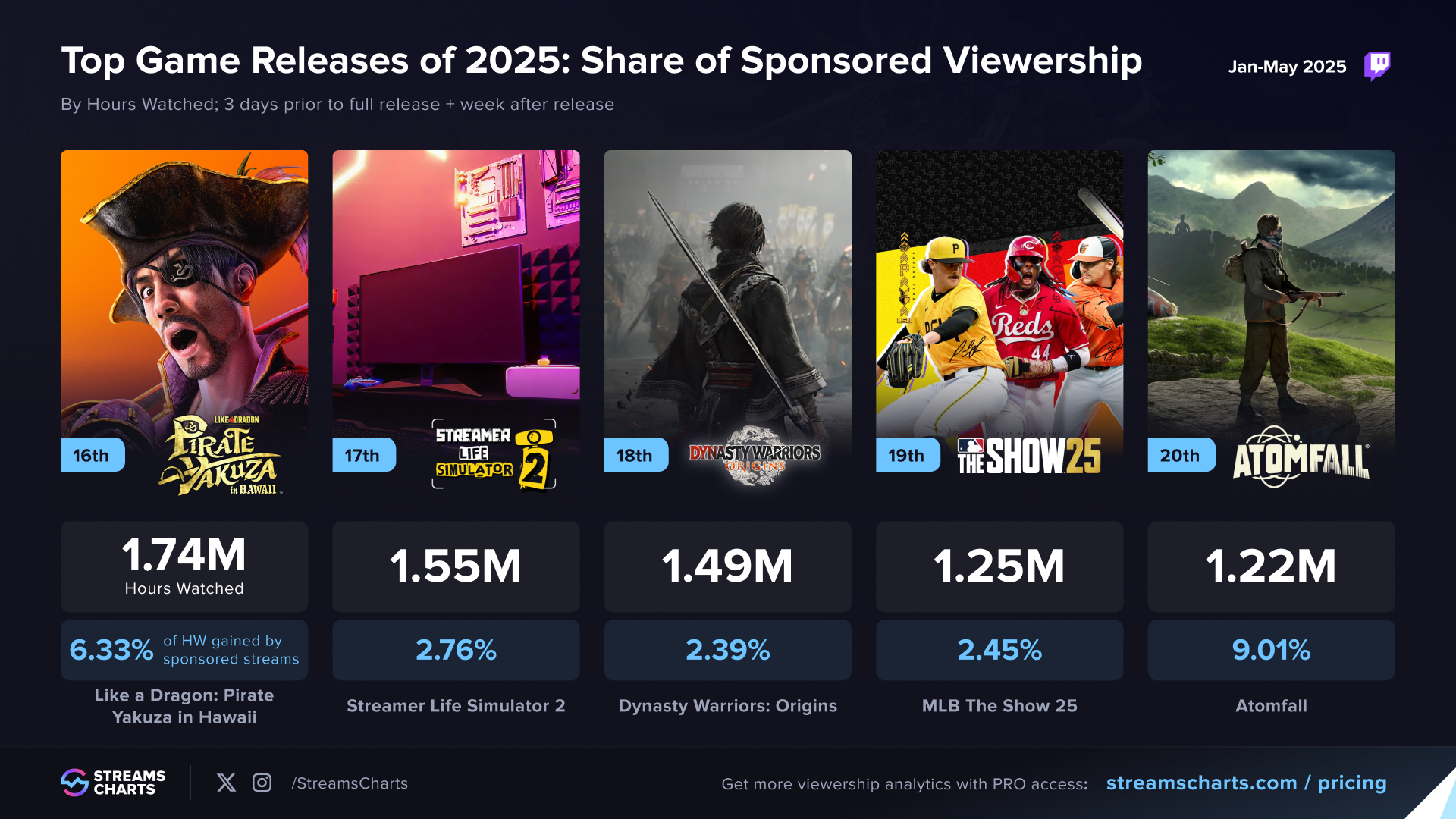

Top Game Releases of 2025, Share of Sponsored Viewership, #11-20

When analyzing the most popular game releases from January to May and their sponsored streams, one trend stands out: publishers overwhelmingly favor English-speaking creators, especially those based in the United States, for promotional campaigns. These streamers range from hardcore gaming channels to variety creators like Hasan “HasanAbi” Piker, whose content isn’t primarily focused on gaming. Female streamers and VTubers also regularly take part in these activations.

Sponsored streams have become a powerful lever for driving awareness and boosting early viewership around new game releases, sometimes accounting for a sizable share of total Hours Watched in a title’s critical launch window. As our analysis shows, these activations can be especially impactful for select games, giving them a strong initial push across livestreaming platforms. At the same time, the data also makes it clear: not every title relies on paid promotion to succeed. Some games naturally capture audiences on the strength of community anticipation, franchise legacy, or viral appeal alone.

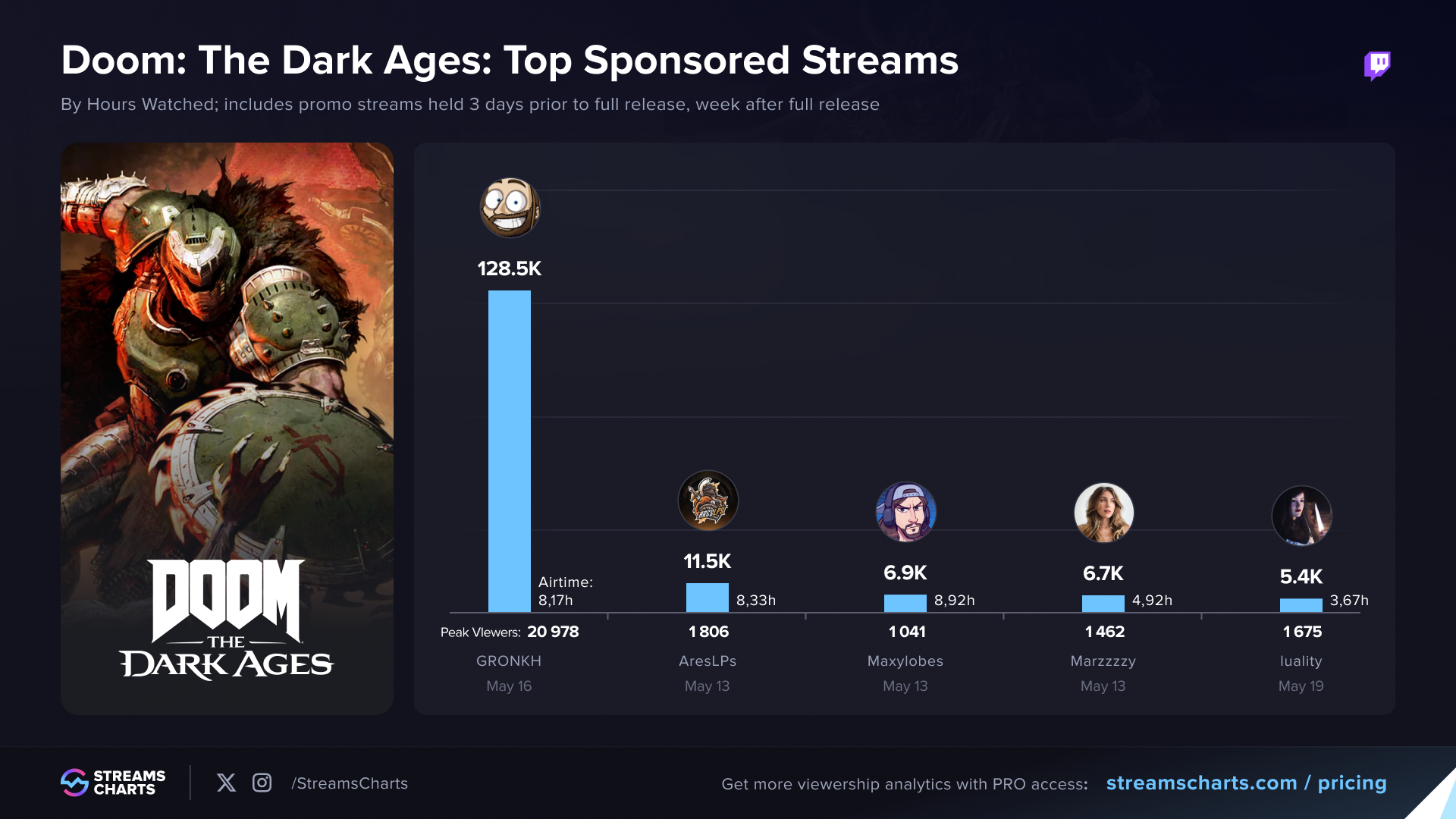

Top Promo Streams of Monster Hunter: Wilds, Doom: The Dark Ages

We’ll return to this topic soon with a deeper look into the economics behind such promotional campaigns, including what publishers might actually pay for these activations, and how variables like streamer region or audience type affect the final price tag.

And remember: with Streams Charts tools, you can run analyses like this yourself. Our PRO subscription includes filters for identifying sponsored content, while additional add-ons give you access to deeper metrics to explore trends and uncover insights just like the ones in this article. You’ll find everything you need to get started on our Pricing page.