In the first half of 2025, audiences spent nearly 60 billion hours watching livestreams, with gaming alone accounting for over 12 billion or about 20% of all livestreaming watch time. Remarkably, just a few dozen publishers were responsible for the vast majority of that gaming viewership. This elite group couldn’t be more diverse: some rule the PC and console space, others dominate mobile; some rely on a single flagship title, while others spread audiences across a portfolio of hits. Even more striking are the platform splits, with Twitch, TikTok, and Kick fostering vastly different viewing habits.

As part of our regular reporting, Streams Charts has compiled the H1 2025 rankings to reveal which video game publishers captured the most attention across Q1 and Q2, and how they managed to dominate the livestreaming stage.

A billion-hour barrier

Only five publishers cleared the 1 billion Hours Watched (HW) mark — and they didn’t just barely make it. They left the competition in the dust. The gap between fifth and sixth place is a jaw-dropping 467 million HW. Meanwhile, the battle for the lower ranks was just as fierce: the tenth-place finisher clinched its spot by a razor-thin margin of only 1.4% more HW than a close rival. Talk about a photo finish.

At Streams Charts, we analyze over 10 major platforms and 52M+ channels, giving brands, publishers, and teams the insights they need to win the battle for livestreaming audiences. From real-time audience tracking to media value analysis, forecasting, and strategy consulting: we help you stay ahead in the fast-changing world of livestreaming.

Peak performers and rising stars

Only four publishers cracked the 1 million concurrent viewers milestone in H1. Leading the pack was MOONTON Games, hitting nearly 4 million peak viewers thanks to the explosive popularity of Mobile Legends: Bang Bang esports. Hot on their heels were Tencent Games, Riot Games, and Valve, all clustered tightly between 1.9 and 2.1 million peak viewers. But sustaining those numbers? That’s a whole different challenge. Just three publishers managed an average of over 300,000 live viewers, proving how rare consistent engagement really is.

Rivalries, platforms, and overlapping audiences

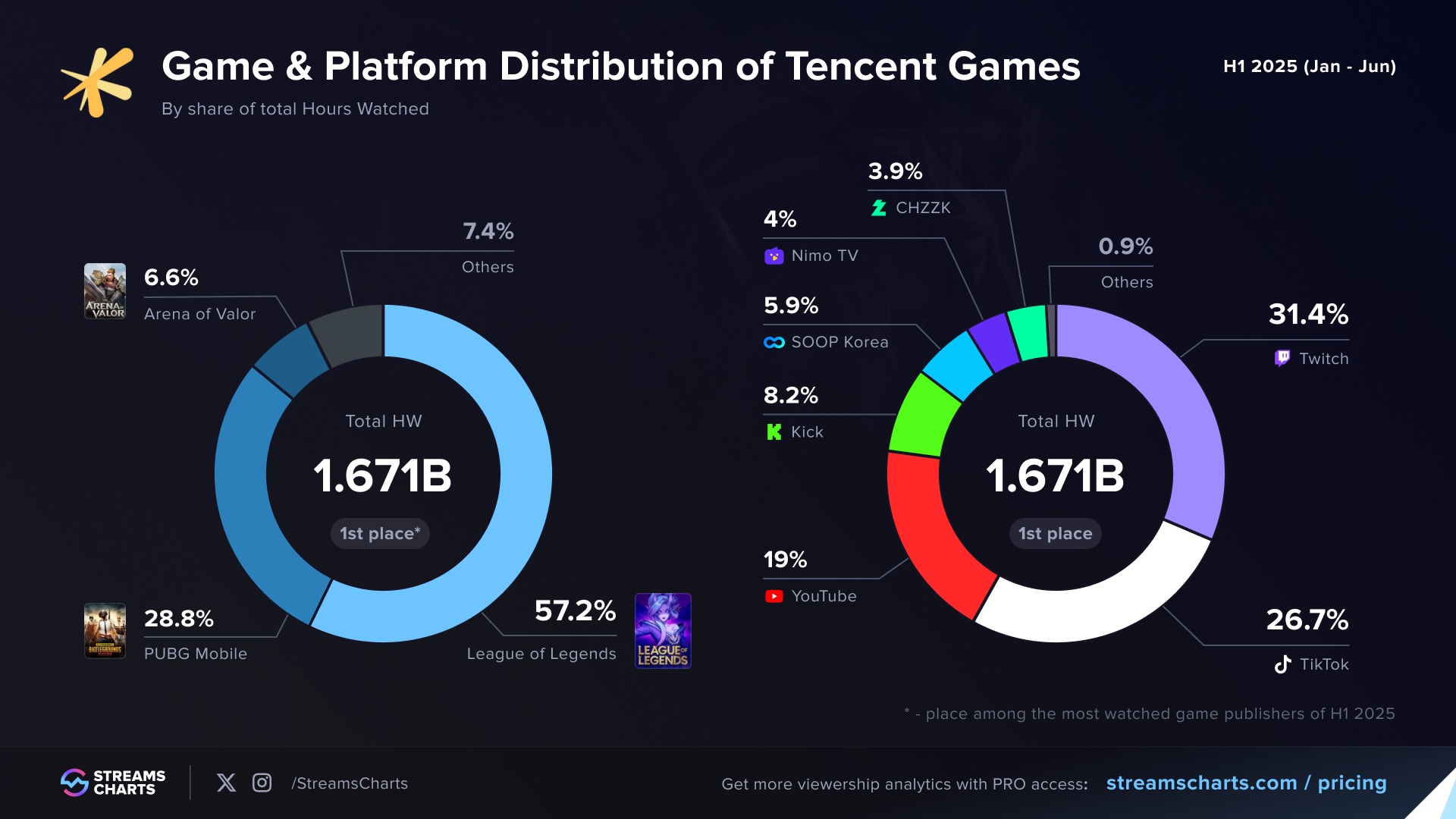

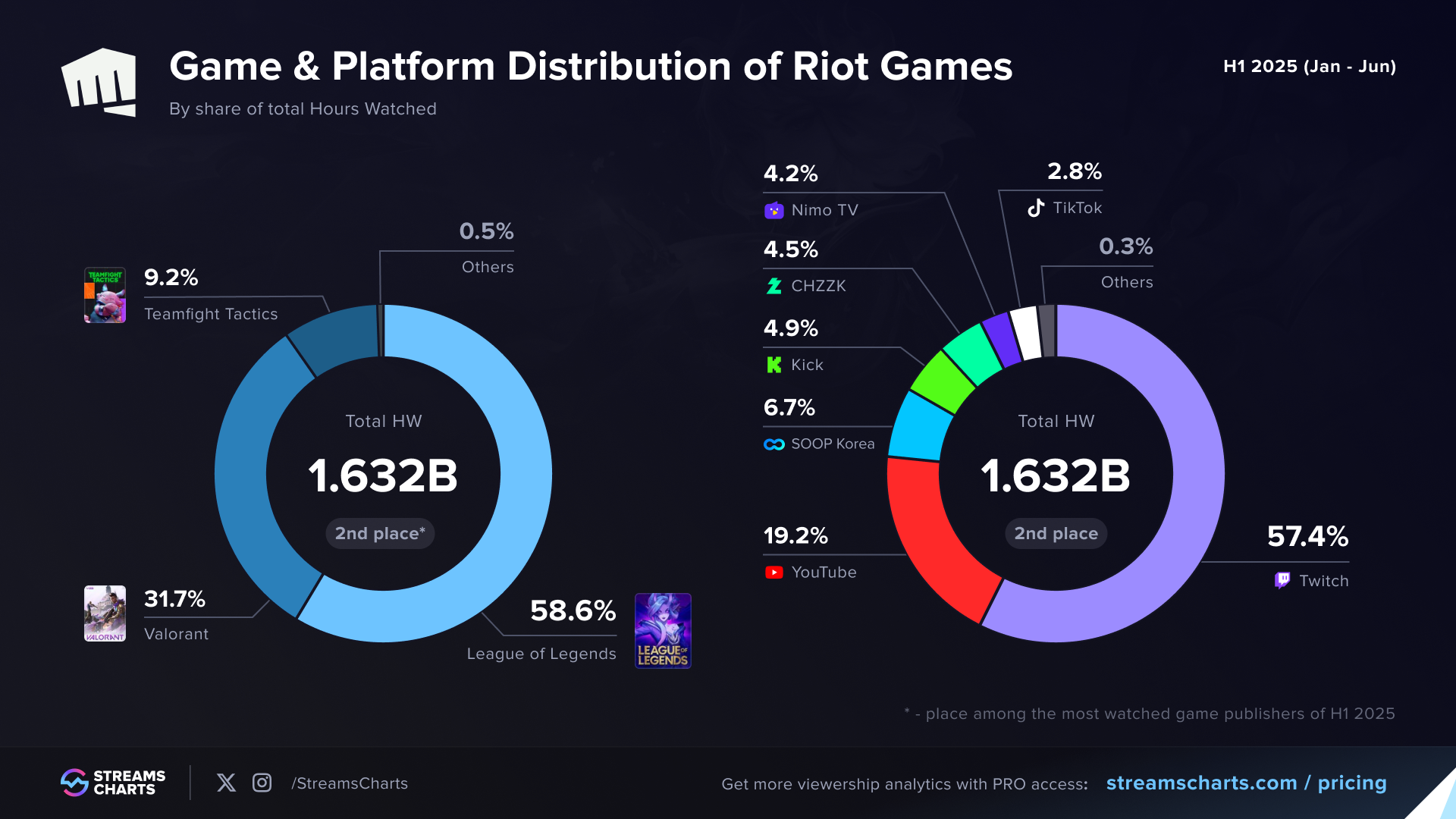

The top spots are dominated by publishers whose hit games overlap, and the dynamics are fascinating. Both Tencent Games and Riot Games owe much of their viewership to League of Legends, but their audiences are vastly different: Riot drives over 57% of its watch time via Twitch, while most of Tencent’s viewers are split between Twitch and TikTok. Tencent also receives a significant boost from PUBG Mobile, which is almost equivalent to Valorant’s viewership for Riot.

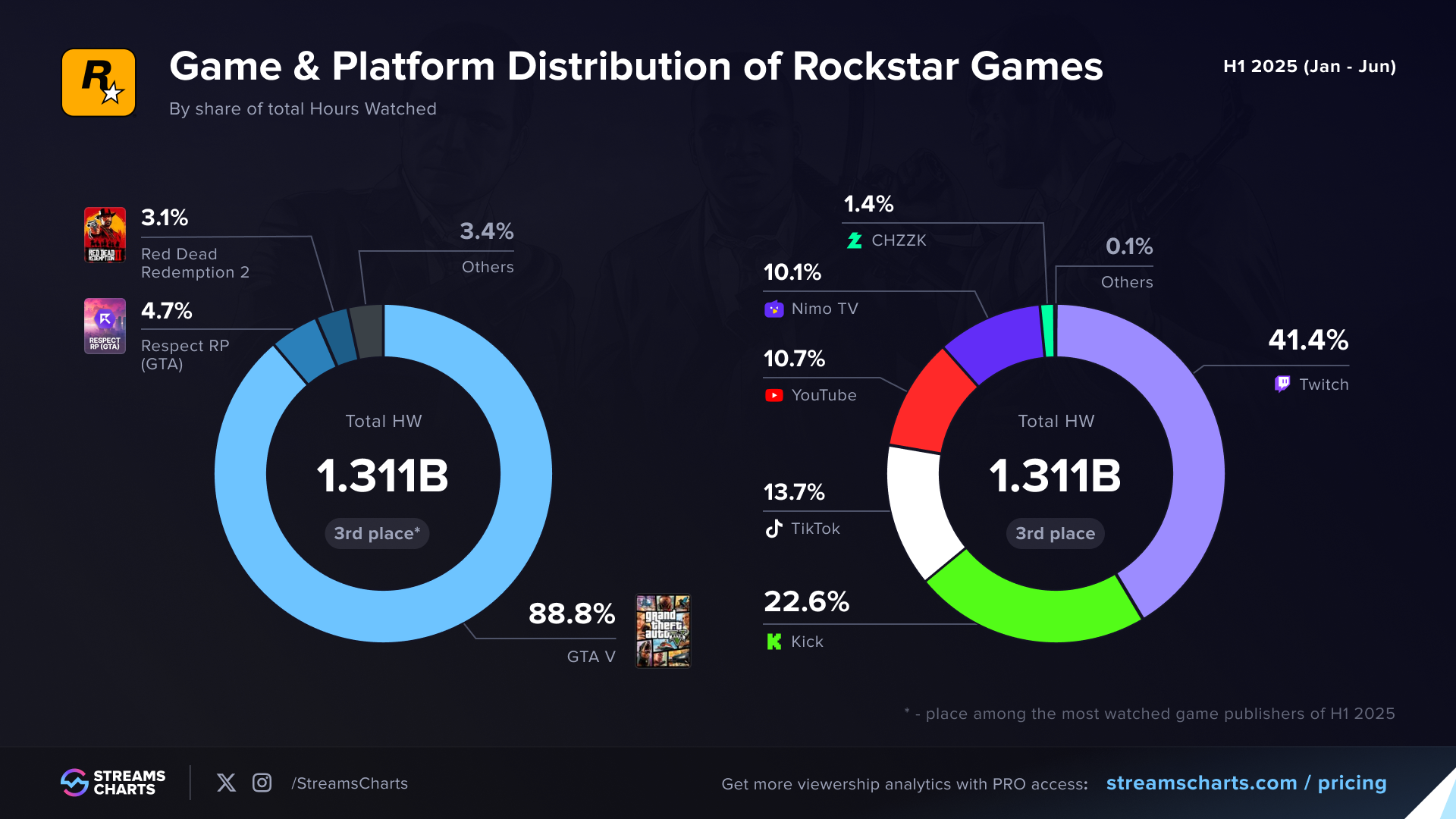

Tencent Games, Riot Games, Rockstar Games: viewership breakdown by service & game

Similarly, Rockstar Games and Take-Two Interactive share dominance thanks to GTA V. The title is especially popular on Kick, where GTA roleplay streams continue to thrive. Meanwhile, Valve remains a multi-title powerhouse, with Counter-Strike and Dota 2 commanding audiences across numerous platforms.

Why it matters

This ranking reveals a critical truth: winning the livestreaming race isn’t just about having the biggest titles, it’s also about sustaining attention in an increasingly fragmented ecosystem. Publishers who build strong esports ecosystems, diversify their presence across platforms, and keep audiences coming back beyond peak moments are the ones pulling ahead.